will long term capital gains tax change in 2021

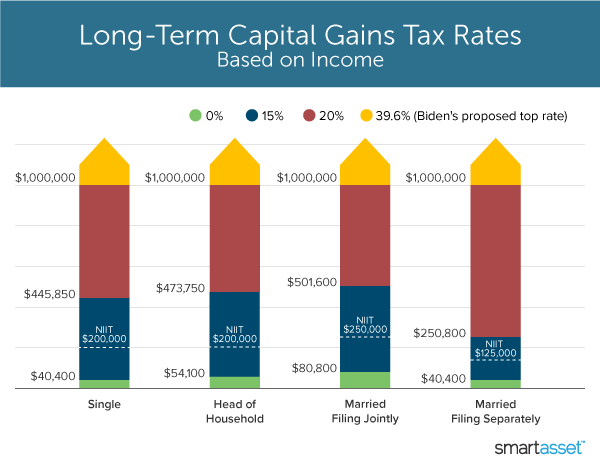

Capital gains tax rates on most assets held for less than a year correspond to. Those earning between 40401 and 445850 will however be taxed 15 percent on their capital gains.

Short Term Vs Long Term Capital Gains Below Infographics Details The Top 5 Differences Between The Short Term Vs Long Te Capital Gain Capital Gains Tax Term

Long-term gains still get taxed at rates of 0 15 or 20 depending on the taxpayers income while short-term capital gains on assets held for a year or less are considered ordinary income for tax purposes.

. Not all capital gains are treated equally. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Below are the official IRS 2021 tax brackets.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. 2021 Capital Gains Tax Rates. But if you waited until July 20 2021 to sell your Litecoin for 107 you would pay 15 in taxes or 975 65 x 15 on your long-term capital gains of 65 107 42.

Harvesting capital gains is the process of intentionally selling an investment in a year when any gain wont be taxed. Tax Tip of the Day. 4 rows If you have a long-term capital gain meaning you held the asset for more than a year.

Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total. Those with a higher income level pay an additional 20 percent tax. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term. While youd pay less in taxes your profit may also be less 5525 instead of 26676. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. Learn about both types in this tax guide. Long-term capital gains are incurred on appreciated assets sold after more than one year.

Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Income from capital gains is classified as Short Term Capital Gains and Long Term Capital Gains. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding any state or local taxes on capital gains.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. Capital gains tax rates will remain the same for 2022 but rate brackets will change. The proposed increase in capital gains tax would raise the tax from 20 percent to the highest of 396 percent affecting the wealthiest taxpayers on gains realized after sept.

Here is a breakdown of long-term capital gains and eligible dividend rates for taxpayers based on their taxable income. November 24 2021 by brian a. Here are the 2021 long-term capital gains tax rates.

Is The Capital Gains Tax Going Up In 2021Is The Capital Gains Tax Going Up In 2021. The 0 long-term capital gains tax rate has been around since 2008 and it lets you take a few steps to realize tax-free earnings on your investments. What Is The Capital Gains Rate For 2021.

Hawaiis capital gains tax rate is 725. The individual will not have to pay capital gains taxes if his or her taxable income falls below 40400 in 2021. Long-term gains still get taxed at rates of 0 15 or 20 depending on the.

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. As amended by Finance Act 2021 TAX ON LONG-TERM CAPITAL GAINS Introduction Gain arising on transfer of capital asset is charged to tax under the head Capital Gains. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business.

The tax rate can change between short-term and long-term gains. This occurs in years when youre in the 0 capital gains tax bracket. 4 rows Additionally the proposal would impose a 3 surtax on modified adjusted gross income over.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. This resulted in a 60 increase in the capital. That applies to both long- and short-term.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Definition 2021 Tax Rates And Examples

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

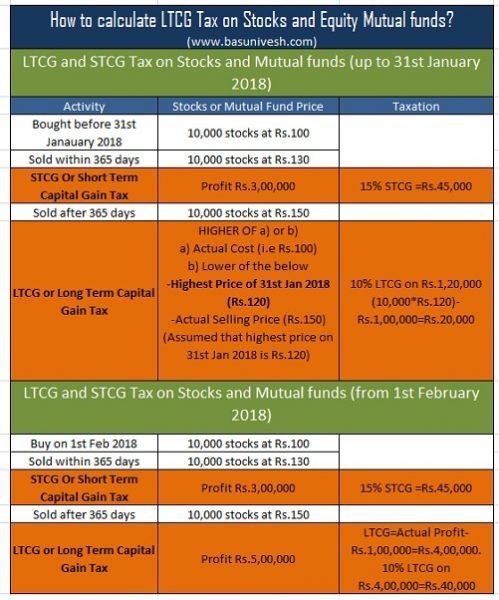

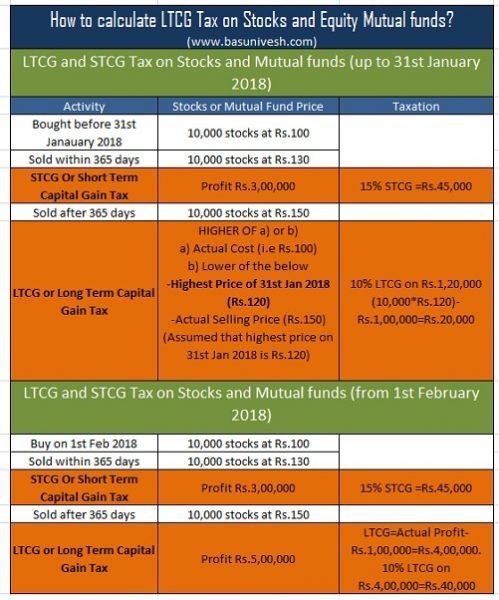

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Real Estate Or Stocks Which Is A Better Investment

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

What S In Biden S Capital Gains Tax Plan Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Selling Stock How Capital Gains Are Taxed The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh